In Economics, our discussions somehow keep circling back to the question of how much retirement benefits Ms. Barbino may get in the coming decade or two. Yesterday, Ms. Barbino mentioned the catastrophic state of the nation’s social security system for the 2nd time just this semester. All of last semester our class kept hearing about how we will not have a retirement fund and will have to give up obscene amounts of our income (taxes) to keep the system afloat for even the next couple of decades. With that in mind, I wanted to do a little more research into how it works.

The first thing I looked into was how Social Security worked. It began as part of the wave of reform under FDR during the Great Depression. It attempted to help the working class retire without facing poverty. The system was built under a pay-as-you-go model where earnings from the current generation of the working class would pay for the people in retirement unable to work. Interestingly, part of the reason why it started this way was to provide benefits for the first generation of retirees who didn’t technically contribute to Social Security. From then on, as each generation retired, the next generation would pay for their retirement.

From there, I sought to understand where all of the money for social security was at the moment. Over the years, the federal government has tried to increase the amount of money they hold in the ‘Social Security bank account’ to better service retirees. I was interested to learn that most Social Security benefits are invested into treasury bonds.

According to The Motley Fool, a widely used financial advisory website, (March 31st 2019)

“Congress has been borrowing Social Security’s asset reserves for decades. The Social Security Administration is required by law to purchase government bonds. Congress uses this borrowed money to fund a variety of line items.”

The government borrows money through Social Security basically investing the money in low-risk assets. This is pretty useful for 2 reasons. First, it inherently helps to grow the fund through interest payments (instead of the transfer payments I had imagined where the money comes out of a person’s income and is sent to an elderly couple somewhere). Secondly, the money they spend on SS gets used by the government for public expenditure.

USA Today furthers in November 2018

“This means borrowed funds could be used to fund defense spending, as well as infrastructure, education, healthcare, transportation or any other federal spending project.”

This also means that the 1.9 trillion dollar covid 19 stimulus package was part of the 28 trillion dollars federal debt part of which is held by Social Security. 3 trillion dollars of that federal debt is held by social security. For me, it was interesting to see how that nebulous number of 30 trillion dollar debt gets broken down into the accounts that finance people’s lives. It is quite literally the nation’s retirement fund which is part of the federal debt, not just some vague lending from China.

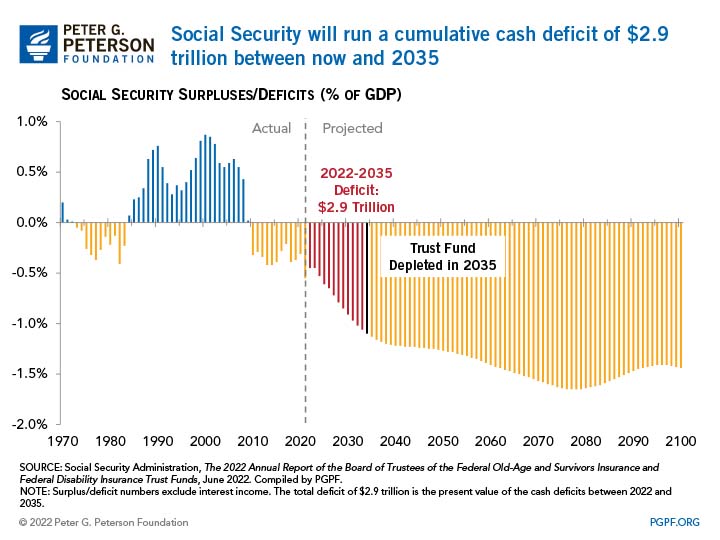

Eventually, I circled back to the question of why social security was failing. Apparently, the cash reserves in things like treasury bonds are no longer being added to. Every year, more benefits are paid out in social security than payroll taxes cover. A big part of the reason why this is happening is because of the Baby Boomers. While the Baby Boomers were in the working class, the Social Security fund didn’t grow corresponding to the boom in output. Without long-term planning, tax revenue was wasted and in some cases not even properly collected. Now, there is a massive elderly population and insufficient funds to meet their demand. The pay-as-you-go model also makes it harder for the current generation to cover the massive costs of the Baby Boomer’s retirement.

An interesting thing I learned was that finding solutions to the problem right now would be better in the long run. In the 2 scenarios of finding a solution today versus in 20 years, the Social Security cash reserves dry up. Meaning that the Treasury has to look for other sources to borrow money and the interest rates that could have been potentially returned on the Social Security Bank account are severely reduced.

Hi Varun! To be completely honest, your blog topic is something I would never look into on my own. Economics isn’t really my thing, but I found your post to be super interesting! I remember learning about the start of Social Security in APUSH and its impact on us in Consumer Ec, but I hate to admit that I’ve retained barely any of that information. Your post was super educating, teaching me much of what I had forgotten from those classes and more. I think the graph that you included is awesome, and makes it easier to understand the issue. I never would have thought that the reason it is failing is because of a past generation, I would have assumed it was because of the nation’s current growing population. It’s crazy to think that if we don’t solve the issue now, the cash reserves could completely dry up in the next 20 years. Do you know what areas the Treasury would borrow money from in order to find a solution?

Hi Varun, I enjoyed reading your blog tremendously. I had always wondered what social security was but curiously never enough to search it up for myself, so reading your blog was particularly elucidating. I like how you explained why the social security system was getting more and more unmanageable baby boomers leaving the workforce; this reminded me of learning about population pyramids in AP Human Geo, and how economics, policy, and even culture changes in a country as it transitions from having a younger population to a middle aged population finally to an elderly population. I wonder if researching how other countries that have higher percentages of elderly citizens (such as Japan and a few Western European countries) tackled the retirement problem would help us fix social security? After reading your blog, I decided to do some more research on social security and the origins of the social security number. I found that social security numbers were originally meant for tax purposes expressly related to the social security program, but have since become the de facto form of identification in the US. Lastly, I wanted to comment on your use of articles like US News and the Motley Fool to develop your point. Overall, you wrote a very engaging post!

Hi Varun! Your post was definitely interesting to read as I didn’t know that I will basically be having super low benefits by the time I retire due to the Social Security cash reserves drying up. With taking Micro/Macro in junior year, I have a common memory of Barbino speaking on current events with her wonderful New York accent. She has a wonderful way of analyzing current events from an economic standpoint. I still remember when Barbino predicted the resources fall-out for many nations after Russia invaded Ukraine, and it was interesting coming to her class and seeing how the new advances of the war affected the global economy. Anyway, for your blog, I was intrigued by your research on how the nation’s retirement funds are basically part of the federal debt. You are right that the Baby Boomer generation was much larger than generations after them, causing the fund to have more money coming out than coming in. Legislation could possibly raise payroll taxes currently to make up the deficit for retirement funds or cut benefits for retirement. Employers would definitely be largely affected if the payroll tax does rise with the inflation rates being absolutely crazy right now. Whatever option, Americans will be angry. It is definitely a concern for Legislation to take upon this issue quickly instead of putting it off, otherwise, it could be a huge problem long-term. My personal opinion is that everyone should invest on their own time for retirement early on. Doing tax-deferred options such as a traditional IRA or a Roth IRA could help with the 401k from employers and social security from the government. Sadly, we learn this way later than we should. If high schoolers could learn to invest correctly in stocks, bonds, mutual funds, and more, we hopefully would be in a good place 20 years from now. Well, this post inspires me to go learn to invest!

Hey Varun, an interesting choice for your blog, to say the least. Although I was somewhat skeptical if you would pique my interest going into your post, I was pleasantly surprised. Your historical context on the topic helped an ignorant fool in me to better grasp the origins of social security. Although I did hear Ms. Barbino reference the detriments of the system, I never fully understood it, including both the issues and potential solutions. Your explanation of the Baby Boomers and the inability to totally afford and sustain their retirements made a lot of sense, as I wasn’t even aware of the issue itself beforehand. Your evidence also helped me a better picture and quantify the system, displaying the weight our national debt holds as the total summation of our retirement fund falls within it. Overall, excellent job breaking down a complex and nuanced issue into layman’s terms, even I managed to understand it.

Such an interesting post!